ACH debit and ACH credit are both payment transfer methods in the ACH (Automatic Clearing House) process. WealthHow will elaborate on the difference between ACH debit and ACH credit.

The NACHA (National Automated Clearinghouse Association) takes care of the innumerable financial transactions carried out every day. After sorting and processing, they are sent electronically, in batches.

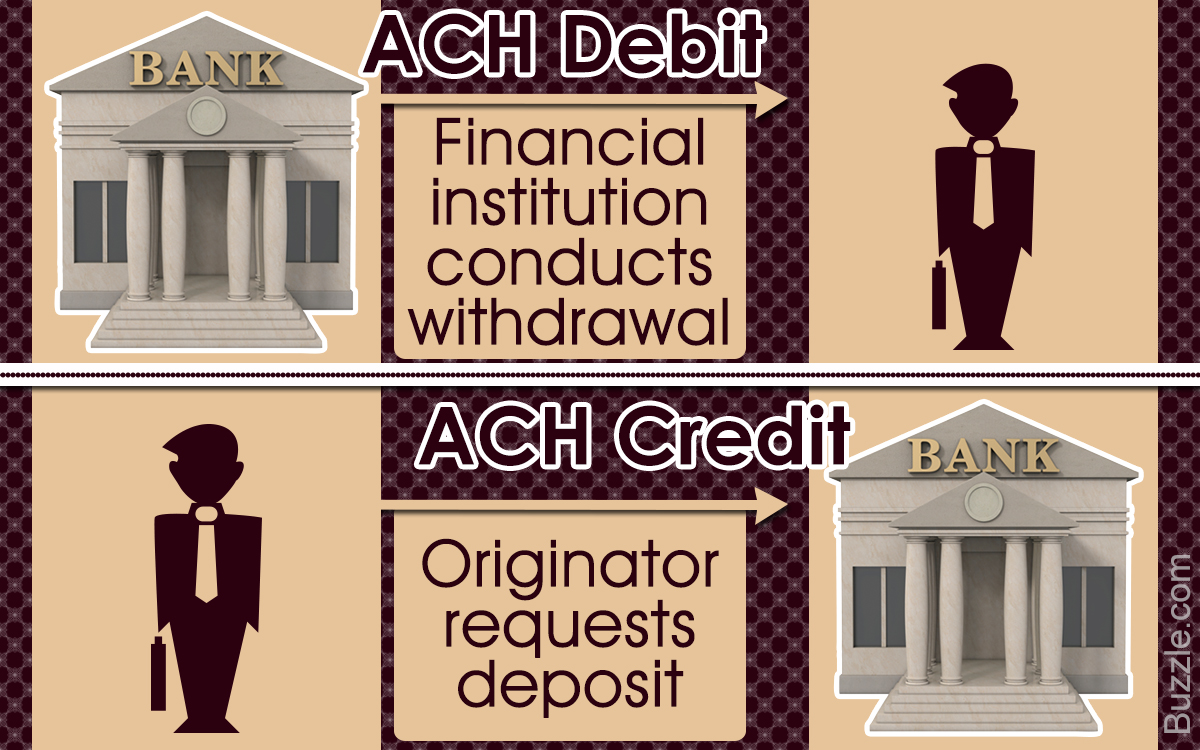

Automatic Clearing House (ACH) is an automated, electronically-operated network that helps transfer money from one account to another. For this as well as other financial transactions, two methods are majorly used; the ACH debit and the ACH credit method. Both methods offer substantial benefits with regard to financial operations. You can choose one or both options, and can also change your option if necessary. The ACH debit vs. ACH credit comparison below will enlist some major differences between both methods.

- It is akin to electronically withdrawing money from your account to make payments.

- In ACH debit, the financial institution is instructed by the individual to make a payment.

- Information about the payment is sent through the Federal Reserve Network to the respective financial institution.

- It is more like depositing money in an account.

- In ACH Credit, the individual/originator/business/agency instructs the financial institution to credit an account with money.

- The payment is made via the ACH to the respective account.

- Through the ACH network, the entity initiates a direct payment transaction.

- When the originator requests a transfer, the request is entered into the ACH system by the Originating Depository Financial institution (ODFI).

- These ACH entries are received either by the Clearing House or the Federal Reserve. They are the ACH Operators.

- The ODFI transmits payments to the ACH Operators in batches.

- The Federal Reserve or the Clearing House sort the different transactions and make them available to the Receiving Depository Financial Institution (RDFI).

- The RDFI then checks on the ACH entry, and the receiver’s account is credited or debited accordingly.

- If it is a debit transfer, the payment is processed and the statement is sent to the receiver.

- The necessary data is transmitted to the financial institution, as per the payer’s request.

- If it is a credit transfer, all the necessary data is provided by the originator to the financial institution. The payment is made after the verification is complete.

- The financial institution is notified by the ACH. The transaction details are mentioned in the bank statements.

- The transaction mostly takes between 1-2 days, in fact, a debit transaction takes only 1 day.

Factors of Differentiation

- Monthly mortgage payments, utility bills, electricity bills, insurance payments, loans, phone bills, premiums, and many other monthly payments.

- Consumer-initiated bill payments, direct deposit payrolls, electronic payments, paycheck deposit, tax refunds, benefits, etc.

- There is no charge or commission on the transfers. The transfer can be initiated by the financial institution upon your authorization.

- The financial institution will charge you a fee for the funds transfer.

- If you have made an error during reporting, you may rectify it in the midst of the process. You will have a specified time period before which the correct payment reporting must be done. You can also call the helpline number. In a worst-case scenario, you can contact your financial institution and request for payment return.

- You can contact your financial institution directly. Make sure you understand the rules and regulations of late payments.

No Tax Liability

- If you have no liabilities on tax for any particular reporting period, you have to report ‘zero’ on the data field in the related form.

- You will have to request your financial institution to generate a zero-dollar transaction.

Payment Due Date

- If your tax/bill due date falls on a holiday, your payment must be done before 4:00 PM CST by the next day.

- Your financial institution will inform you when the payment will be made in case of a holiday.

- Extra 10 days for payments on taxes, duties, and fees

- Cash flow control by means of accurate fund allocation date

- Reduction of administrative errors

- No lost/stolen check problems

- Reduction of hectic data processing

- Payment of statements at a single, central location

- User control on payment timings

- Reduction of check processing costs

- Immediate transaction posting

- No lost/stolen check problems

- User control on the date of fund debit

- Much lesser costs than the FEDWIRE

While choosing either of the ACH debit or credit options, remember the security measures and the rules of the state. And, for any transaction, keep in mind the rules and regulations regarding the taxation. If used wisely, these ACH methods are very efficient for conducting financial transfers.