People do go to extreme lengths to protect their money from the taxmen, and justifiably so. Weren't you always under the impression that the taxmen and their ilk would never suffer fools gladly? Well, usually they don't, but when they do, hilarity ensues …

The dreaded tax season is here, and most of us are scurrying to meet the filing deadline. Parting with our hard-earned money doesn’t exactly make us jump with joy, but it does lead to our brain cells working in overdrive. As the battle to lower the taxable income mounts, some individuals come up with some absolute gems that qualify as tax deductions.

While some are daring, some are sheer genius. Some hit the bull’s eye, while some just leave the applicant red-faced. Get started and get inspired!

Strange Tax Deductions

Music to the Rescue

Clarinet classes, to be precise. A woman was allowed a tax deduction for the money she had to pay for her child’s clarinet lessons.

So, can all aspiring musicians celebrate? Oh, if only! The lady in question was allowed the deduction because taking those classes corrected her child’s overbite.

If you happen to have an overbite, you know what to do.

Who Moved My Pets?

Relocation is not something we always look forward to, especially when it’s not something we really want to do.

But, assuming you fulfill the two qualifiers set for this deduction, your pets can be considered as “your property” and moving them will give you a tax deduction.

Unless you rent a stretch limo to transport your pug.

A Well-oiled Deduction

A wrestler claimed a tax deduction on the body oil expense he underwent.

The tax police were convinced that this was a “business expense” as the oil was used to add sheen to his muscles when he participated in competitions. Before you yell in outrage, Mr. Wrestler was not allowed deductions on his food expenses.

Sorry, your weekly spa trips for avocado oil massages are not “business expenses”.

Swim your Way Out …

… Just as one fellow with arthritis did. If you suffer from a medical condition that can be alleviated by swimming, you are allowed a tax deduction on the construction of your private pool.

Wait, it gets better. The IRS included the upkeep costs as well. Very considerate of the IRS indeed.

Let’s just hope you never face a situation where you’d need to use this deduction.

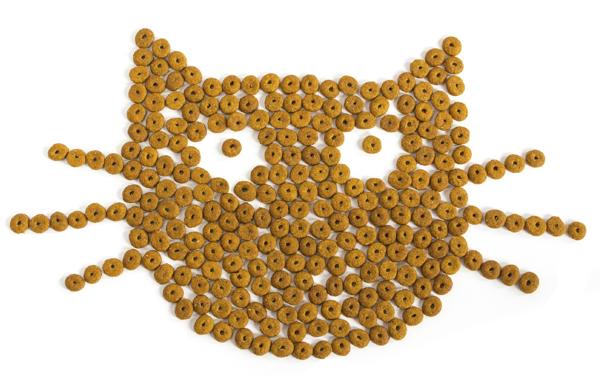

Nothing Catty About it

Who would’ve guessed that the IRS were cat people? Well, not the relatively tamer domestic ones, but their wilder cousins. These junkyard owners who were terrorized by rodents set out food for the wild cats in order to attract them.

The cats happily helped themselves to the food and the other food, as a result, the owners coolly claimed cat food money as a deduction.

The IRS thumb rule for cats? The wilder, the better!

Off to the Beach!

Everyone loves business trips and the IRS is no different.

So when you schedule one in Bermuda, Barbados, Costa Rica, Dominica, the Dominican Republic, Grenada, Guyana, Honduras, Jamaica, Saint Lucia, Trinidad and Tobago, Canada or Mexico, the IRS allows you the cut, without much hassle.

And you thought business could never be a pleasure!

Quit Smoking!

The IRS thinks it’s a nice thing to do, and they encourage programs that push you to quit smoking. But there’s a catch.

The tax deduction is allowed exclusively on prescribed quitting drugs. Nicotine patches or gum are excluded. Sorry, but this is the IRS, we’re talking about.

To light or not to light, is something you need to decide.

Did Someone Say Beer?

You heard it right. A gas station owner distributed free beer to his customers as a promotional activity, and got away with it.

How? Under the guise of our dear friend, the “business expense”; a boon for a bargain-hunter like this gas station guy.

It’s beer. I zip my mouth.

Jet, Set, Fly!

When you rent a condo that’s miles away from your home, isn’t it a pain to drive for hours to reach it?

Actually, no, if what you’re driving happens to be a jet. The couple that did this were granted a tax deduction on all their flying expenses on the trips they took to their condo.

Who said that a jet-setting lifestyle burnt a hole in your pocket?

Getting in Shape

Getting in shape is good, and it’s safe to say that most of you will second it. It would be great if you get a tax deduction on the cost incurred, isn’t it?

Your wish is granted, albeit under special circumstances. Your doctor needs to qualify your extra weight as life-threatening, only then do you get to apply for this deduction.

Throwing your weight around does have some advantages.

You can come up with several other expenses that qualify as tax deductions. All that is needed is a little daring and a little impishness. Avoid excess frivolity, and just make sure you don’t get on the wrong side of the law!